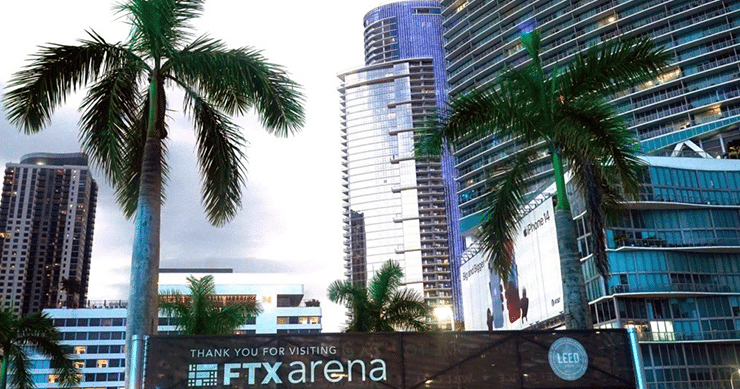

On Friday, crypto exchange FTX recommended users delete FTX apps and avoid using its website, backing up rumors of a massive crypto hack.

The accounts of several wallets of the crypto exchange are also reporting that they are down to a zero balance and experts also noted that FTX’s API was unavailable.

On the FTX Support Telegram group, an account administrator wrote, “FTX has been hacked. FTX apps are malware. Delete them. Chat is open. Don’t go on FTX site as it might download Trojans,”

Hours later, FTX General Counsel Ryne Miller confirmed the hack when he tweeted that the crypto exchange was making ”every effort to secure all assets, wherever located.”

Later on, Miller announced that they were moving all assets to cold storage to mitigate the effects of the disaster. “Following the Chapter 11 bankruptcy filings – FTX US and FTX [dot] com initiated precautionary steps to move all digital assets to cold storage. Process was expedited this evening – to mitigate damage upon observing unauthorized transactions.”

The crypto exchange filed for bankruptcy on Friday, Nov. 12, after a large number of customer withdrawals. The alleged hack occurred hours later. According to experts, customer funds that have vanished from the collapsed crypto exchange may surpass the hundred millions and even reach a billion.

This was a steep fall from a thriving company that was once the poster boy of the crypto industry. In January, FTX raised $400 million from investors, valuing the company at $32 billion.

“The shock was that this guy was the face of the crypto industry and it turned out that the emperor had no clothes,” said Thomas Hayes, managing member at Great Hill Capital LLC in New York.

Since the field of crypto remains mostly unregulated, there is no arguing with the fact that no exchange is completely safe. The future will tell if the FTX downfall and other similar headlines will pave the path for more secure crypto platforms.