Leverage the Power of Centraleyes

in the Cyber Insurance Domain

- Home

- Leverage the Power of Centraleyes

in the Cyber Insurance Domain

Leverage the Power of Centraleyes in the Cyber Insurance Domain

Brokers

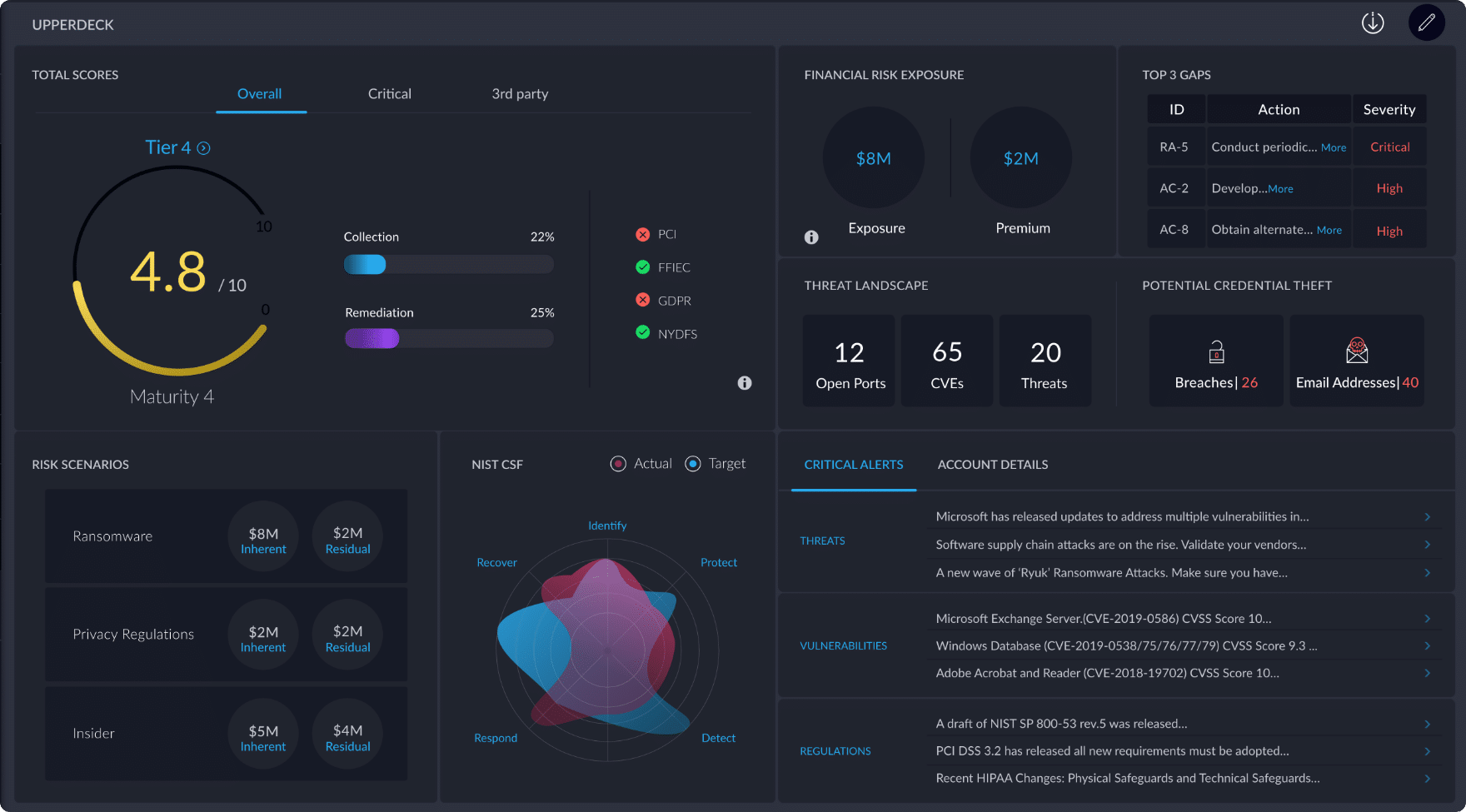

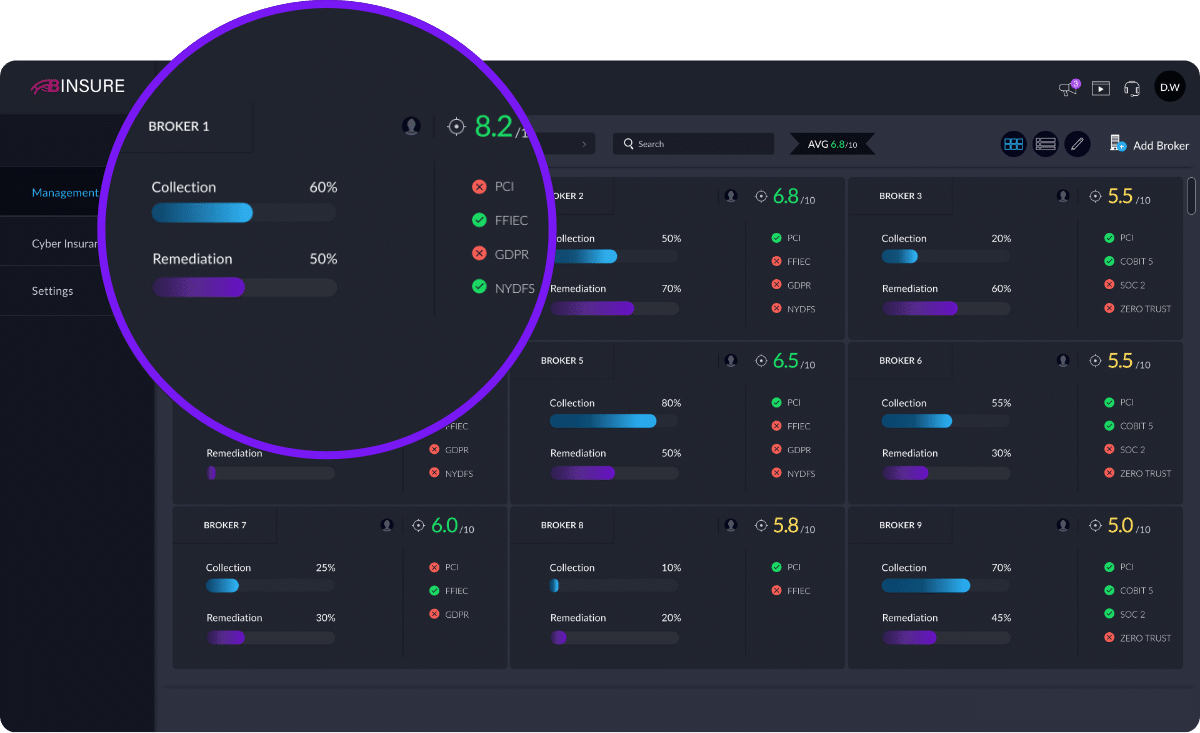

Improving your client’s cyber resilience will increase approval rates while ensuring competitive proposals and lower premiums across your portfolio. Centraleyes’s SaaS platform allows you to easily assess client risk posture and generate carrier-specific applications at the click of a button. Provide clients with real-time data feeds and intelligence to mitigate their cyber risk throughout the duration of their policy.

Carriers

As an insurance carrier, you can lower claim rates by helping your customers reduce their cyber risk exposure, and encouraging them to keep their security scores high. Streamline risk quantification and provide automated remediation workflows to empower your clients with a clear path to cyber maturity, while seamlessly working with your broker and agents all in one single pane of glass.

Clients

Cyber insurance coverage requires a high level of due diligence on the part of prospective policyholders. To get the most out of your application process, Centraleyes helps you quantify your cyber risk exposure to better assess your insurance needs. By increasing your cyber resilience and mitigating risk, you can lower premiums and reduce the chance of being breached.

Our powerful cloud-based platform gives you real value by providing an integrated platform that generates automated deep insights, gap mitigation plans, and risk scenarios.