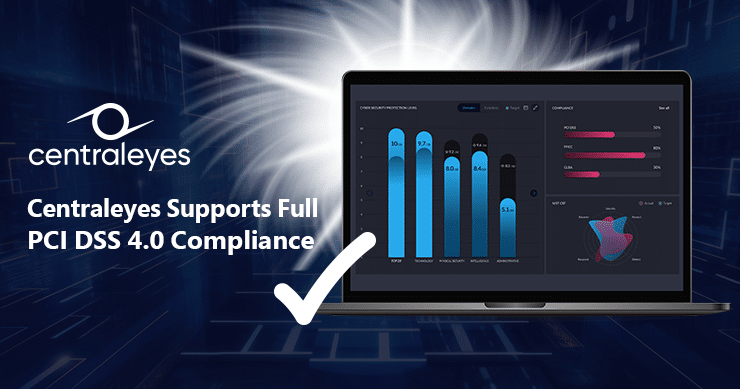

Centraleyes proudly announces its full support for the Payment Card Industry Data Security Standard (PCI DSS) version 4.0 on its platform. With the introduction of PCI DSS 4.0, Centraleyes stands out as the go-to solution for organizations seeking comprehensive, real-time compliance management.

PCI DSS is a set of security standards designed to ensure the protection of payment card data. As the payments landscape evolves, it’s crucial for organizations to stay ahead of the curve and maintain compliance. PCI DSS 4.0 represents a significant milestone in the world of payment card data security, and Centraleyes is at the forefront of this transition.

Key PCI DSS 4.0 Highlights supported by the Centraleyes platform:

Start Getting Value With

Centraleyes for Free

See for yourself how the Centraleyes platform exceeds anything an old GRC

system does and eliminates the need for manual processes and spreadsheets

to give you immediate value and run a full risk assessment in less than 30 days

- Full PCI DSS 4.0 Questionnaire Integration: Centraleyes has seamlessly integrated the entire PCI DSS 4.0 questionnaire into its platform. This means that organizations can now assess their compliance status against the latest standards effortlessly. The platform provides clear, actionable insights into areas that require attention and remediation.

- Real-time Compliance Monitoring: Centraleyes’s innovative platform offers real-time monitoring of compliance efforts. This feature ensures that organizations can continuously track their progress, identify vulnerabilities, and make necessary adjustments promptly. With the evolving threat landscape, real-time monitoring is more critical than ever.

- Customized Remediation Plans: Centraleyes helps organizations create customized remediation plans based on PCI DSS 4.0 requirements. This ensures that businesses can efficiently address compliance gaps and reduce the risk of data breaches.

- Automated Reporting: Generating compliance reports can be a time-consuming task. Centraleyes simplifies this process with automated reporting features, allowing organizations to streamline their reporting efforts and meet PCI DSS 4.0 requirements efficiently.

- Expert Support: Centraleyes offers expert support to help organizations navigate the complexities of PCI DSS 4.0. Their team of compliance professionals is readily available to provide guidance and answer any questions, ensuring a smooth transition to the new standards.

Yair Solow, Founder and CEO of Centraleyes, expressed his excitement about the platform’s latest update: “At Centraleyes, we are dedicated to helping organizations achieve and maintain compliance with industry standards. PCI DSS 4.0 represents a significant shift in payment card data security, and our platform is fully equipped to support our clients through this transition. We are committed to simplifying compliance management, reducing risk, and ensuring the security of payment card data for our clients.”

With Centraleyes’s support for PCI DSS 4.0, organizations can confidently address the challenges posed by the latest version of the standard. By utilizing the Centraleyes platform, businesses can fortify their security posture, reduce the risk of data breaches, and uphold the trust of their customers.

For more information about Centraleyes and its PCI DSS 4.0 compliance capabilities, visit www.centraleyes.com.

About Centraleyes:

Centraleyes is a next-generation GRC platform that gives organizations an unparalleled understanding of their cyber risk and compliance. The platform addresses the main pain points of GRC by providing no-code deployment with single-day implementation and onboarding, automation and orchestration of data collection and analysis, and real-time dashboards and reports that enable its customers to make smarter strategic decisions. This is truly cyber risk management reimagined.