Automate and Orchestrate

Cyber Insurance Applications

- Home

- Automate and Orchestrate

Cyber Insurance Applications

Automate and Orchestrate

Cyber Insurance Applications

The Centraleyes Advantage

Need to build customized insurance portfolios that align with the security posture and risk management goals of your clients?

We can help you with that.

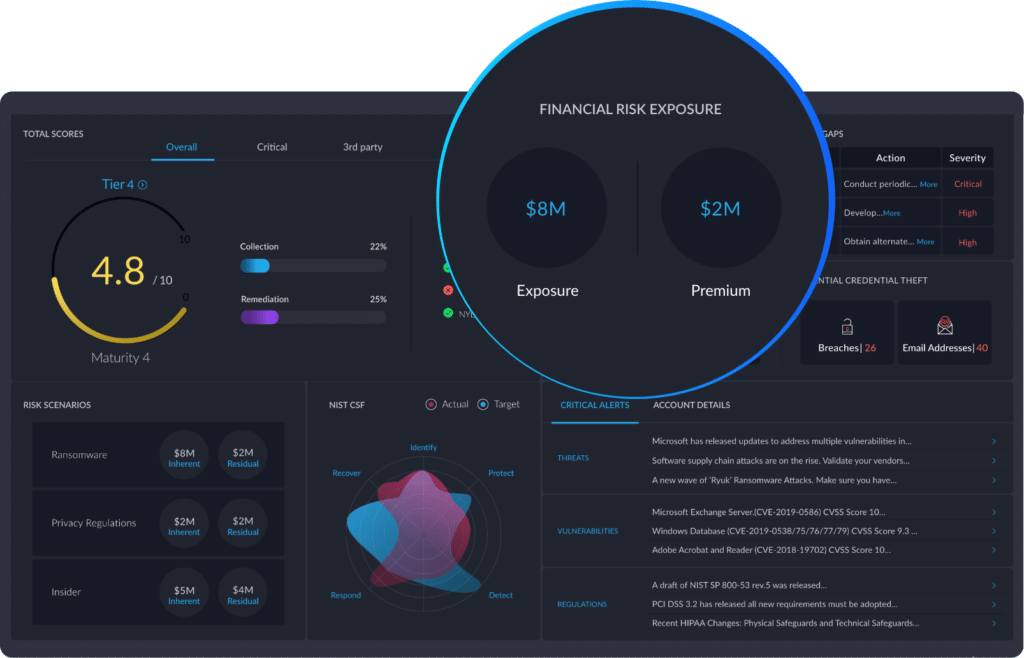

Cut through the arduous complexity of calculating premiums based on spreadsheets and statistical data. Access hard numbers and financially quantified risk assessments to gain an understanding of client cyber risk maturity. Our platform, designed for a wide range of sectors and risks, is streamlined and agile, enabling you to adapt quickly to changing market conditions while offering customized policies and contract certainty.

Our powerful cloud-based platform gives you real value by providing an integrated platform that generates actionable deep insights based on automated darknet, public net, and perimeter scanning.

With Our Platform You Will

Mitigate client risks and offer competitive premium rates

Increase the percentage of policy renewals

Base initial quotes on clear and accurate data

Simplify underwriting procedures

Reduce Risk and Premiums

Centraleyes risk management platform helps you execute policies that deliver on the expectations of customers and brokers alike by reducing risk and premiums.

Complex underwriting procedures can stretch out application onboarding and renewal processes for weeks or months. At Centraleyes, we value “underwriting through understanding” and equip you with the solutions you need to access accurate, fact-based, and quantifiable information for more data-driven decision-making and cost-effective portfolio transactions.