Automate and Orchestrate Risk Management

for Cyber Insurance

- Home

- Automate and Orchestrate Risk Management

for Cyber Insurance

Automate and Orchestrate Risk Management

for Cyber Insurance

The Centraleyes Advantage

Cyber resilience starts with an intuitive, in-depth risk assessment. Centraleyes risk assessment and quantification tools are designed to determine the likelihood and the financial impact of cyber risks and to identify security gaps in your systems. Our powerful platform generates the actionable insights you need to understand what your cyber risk level means to your business.

As insurance carriers become increasingly selective about which businesses they are willing to underwrite, insurers have raised their coverage threshold to strict standards of minimum cyber hygiene. Centraleyes’ platform identifies vulnerabilities in your system, facilitates risk mitigation,

and ultimately gets you to a state of cyber-readiness so you can approach the insurance application process empowered with our expertise and a strong cyber posture.

With Our Platform You Will

Mitigate client risks and offer competitive premium rates

Increase the percentage of policy renewals

Base initial quotes on clear and accurate data

Simplify underwriting procedures

Need to figure out how much cyber insurance you need?

That’s what Centraleyes can help you with.

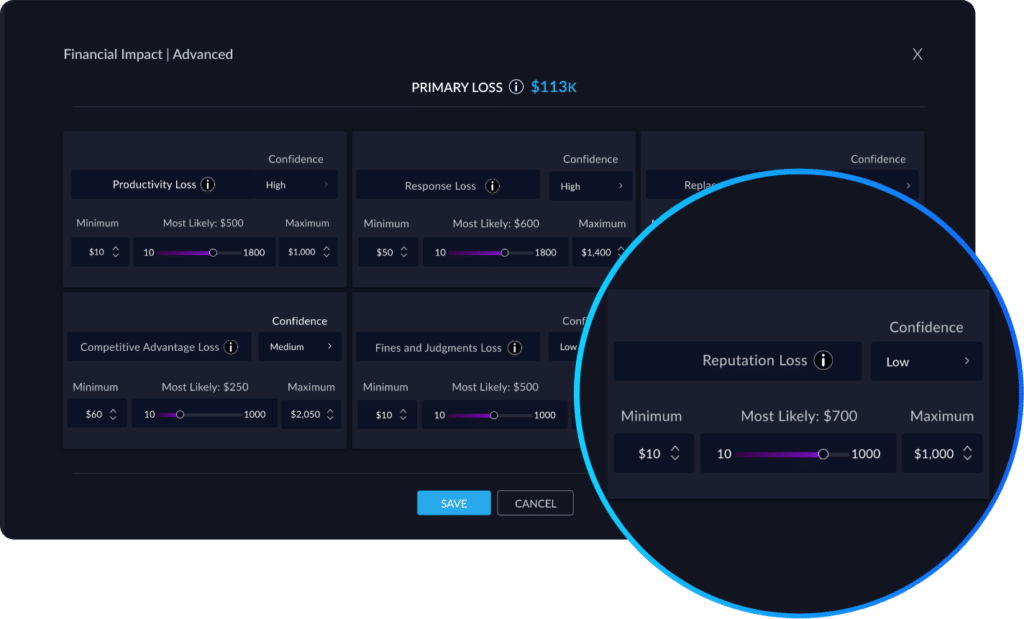

The Centraleyes platform contains a wildly popular cyber risk quantification tool called the “Primary Loss Calculator”. This advanced risk quantification tool provides the clarity and visibility around cyber insurance that your business needs to drive critical decisions.

By conducting cyber risk quantification, you can weigh potential risk scenarios and their losses against cyber insurance policy limits and accurately assess your insurance needs.