Automate and Orchestrate You

Cyber Insurance Program

- Home

- Automate and Orchestrate You

Cyber Insurance Program

Automate and Orchestrate You

Cyber Insurance Program

The Centraleyes Advantage

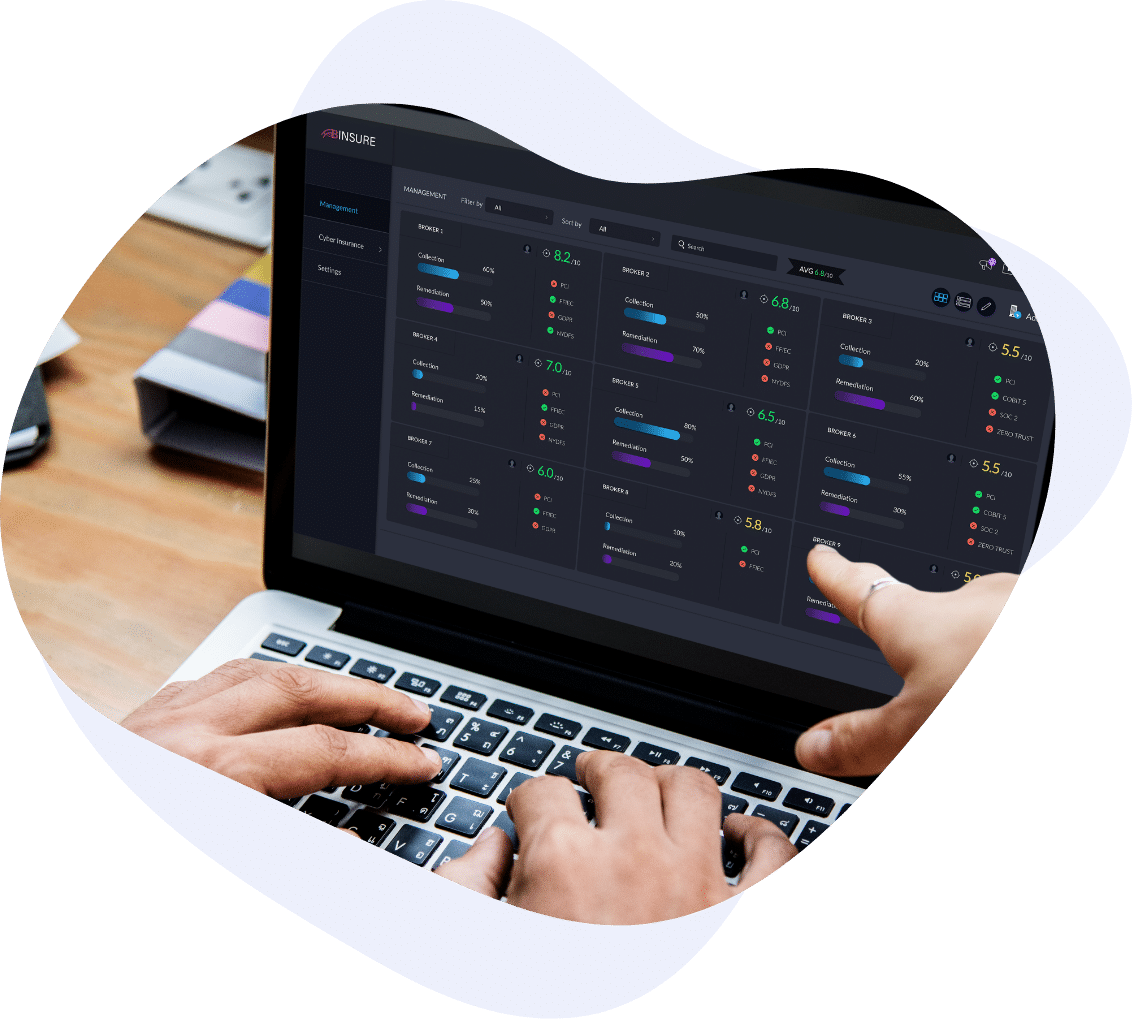

Accurately measuring your clients’ security posture is crucial to navigating them through the cyber insurance approval process. Our fully integrated platform collects real-world data to assess risk and develop true insight into client cyber risk exposure.

Centraleyes’ advantages lie in its fine-tuned cyber risk evaluation, financially

quantifiable risk assessment, and streamlined carrier-specific onboarding processes.

With Centraleyes, gain a thorough understanding of your clients, present their best possible risk profile to the insurance marketplace, and develop strong relationships with carriers to ultimately create a seamless, automated workflow that traverses the complex cyber insurance application process.

With our platform you can

Process multiple applications with one click

Access preloaded carrier-specific applications

Automatically map between frameworks and insurer requirements

Achieve better premium rates for clients

Manage risk as it relates to cyber insurance

Increase the percentage of policy renewals

Come Out Ahead in the Cyber Insurance Market

Insurance carriers have become increasingly selective about which businesses they are willing to underwrite and have raised their coverage threshold to strict standards of minimum cyber hygiene. As a result, insurance premiums have risen sharply across all industries and many cyber insurance brokers have been turning away prospective clients due to the increasingly stringent pre-application and onboarding requirements demanded by insurers.

Given the tight supply in the market of cyber insurance, an integrated solution that streamlines the assessment and application process, enabling you to offer policies that are tailored to the specific needs of your clients, is key to your success as a selected broker.

Accurately Assess and Convey Cyber Risk

With Centraleyes, benefit from our pre-populated risk assessment questionnaires that automatically map to leading frameworks and standards to help you convey cyber risk posture to multiple insurers simultaneously, guaranteeing a more productive, less redundant application and underwriting process.