M&A Risk Management

- Home

- M&A Risk Management

Don’t Let Due Diligence Derail Your Acquisition

Revolutionize your M&A process with an all-in-one risk management solution that lets you streamline evaluation and onboarding at scale.

Multiple Targets,

Multiple Tenants

Evaluate multiple acquisition targets in real-time by seamlessly deploying a Centraleyes tenant to each one

Ask The Right Questions

Establish a risk profile for each target with pre-built intake questionnaires, and assign questions to individual users

Map, Analyze, Report

Connect your evaluations to multiple frameworks and standards, and ensure your acquisition is fully compliant

The Challenge:

Avoiding a Risky Investment

Per Deloitte, the M&A process is rife with risk at each and every stage, from

strategy to integration.

You need to understand those risks, just as you need to understand the shortcomings of each acquisition target. It’s not just a matter of protecting your own assets from digital threats but also about ensuring you don’t overpay for a business with a poor security posture or inadequate cyber resilience.

You need to establish a comprehensive risk profile for each target. Yet that can be difficult to do, especially in a competitive market where each acquisition target is likely being courted by multiple competitors. To avoid unwanted surprises and make smarter acquisitions, your M&A cyber risk due diligence process needs to evolve.

Centraleyes: M&A Risk Management Simplified

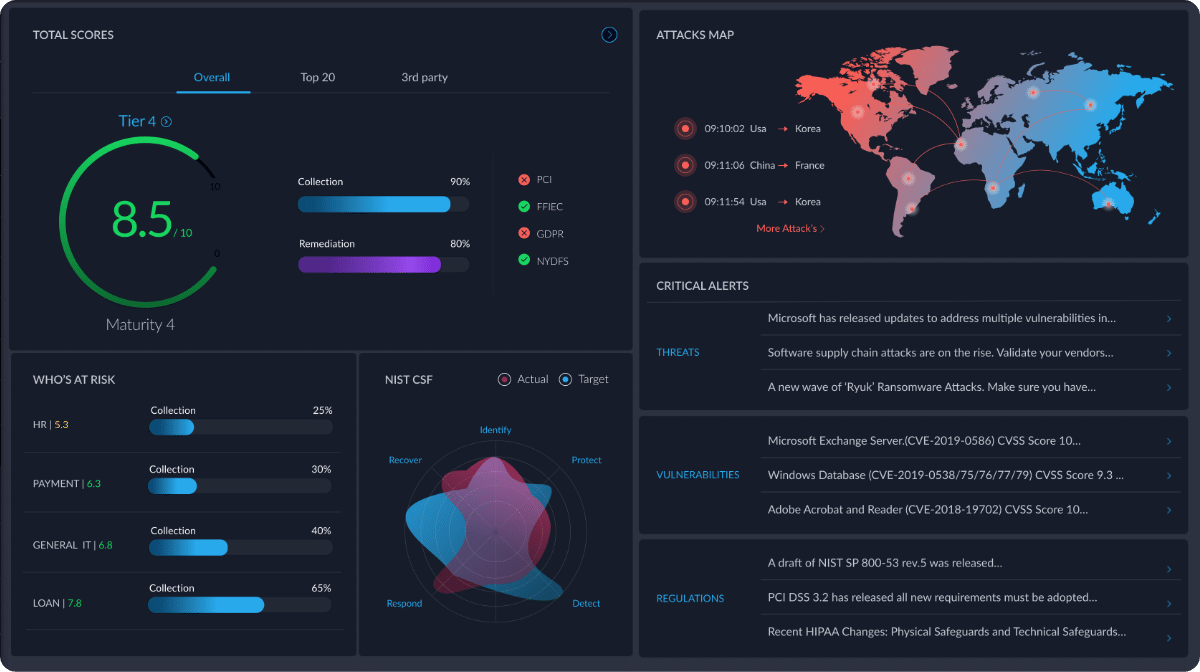

Centraleyes is the world’s most advanced cloud-based integrated risk management platform, and it has the potential to revolutionize your M&A process. Through multi-tenant deployments and pre-built questionnaires, it allows you to evaluate multiple acquisition targets quickly and more efficiently. Through cutting-edge artificial intelligence and automatic data aggregation, Centraleyes empowers you to seamlessly identify threats, classify targets based on risk, define security goals, and provide remediation advice.

Top Features

Advanced visual reporting

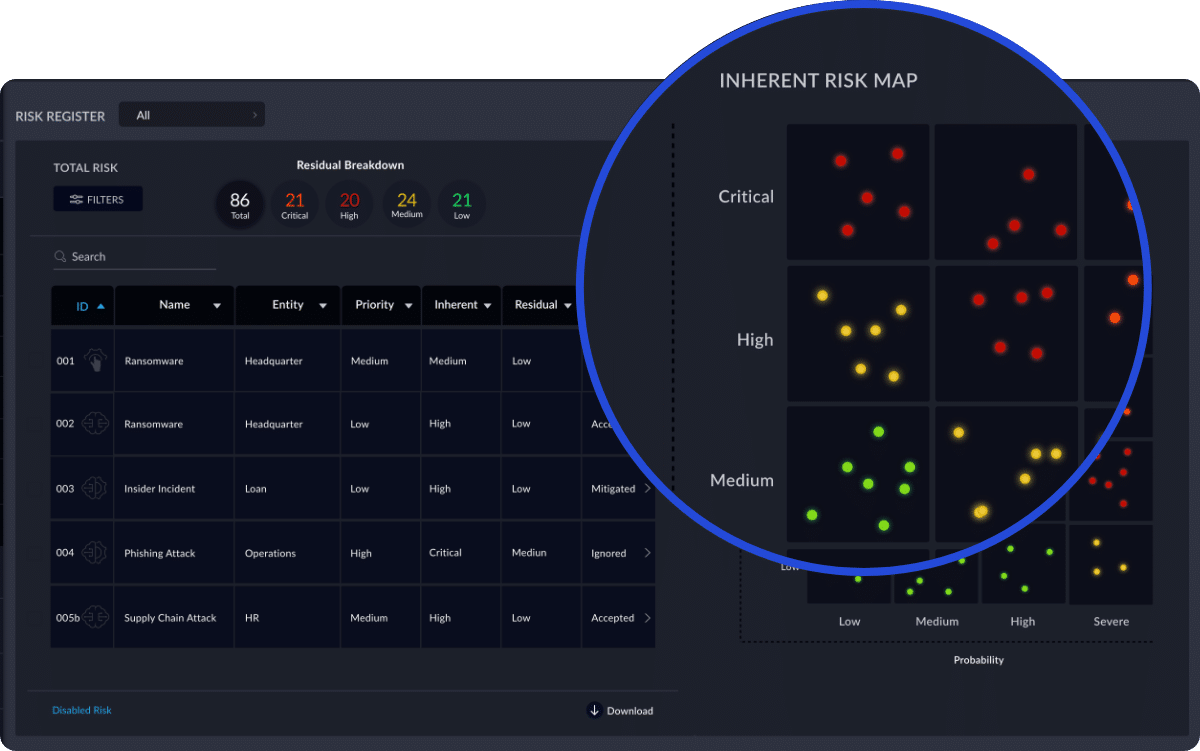

Risk Register for streamlined benchmarking and prioritization

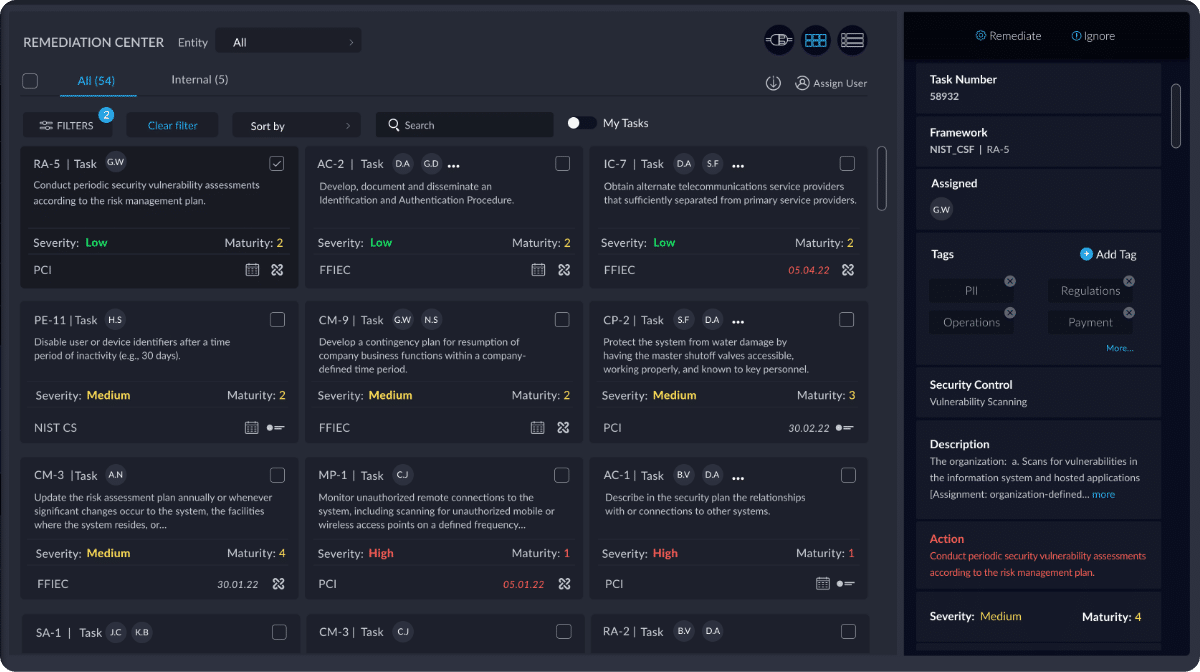

AI-powered planning, orchestration, and remediation

Intuitive risk scoring for multiple organizations

70+ Pre-loaded industry frameworks and standards

Multi-tenancy

Key Benefits

- Deploy Centraleyes to M&A targets in seconds

- Quantitative metrics and intuitive risk scoring for M&A cyber risk

- Multi-tenant management layer displays all client data

Ensure Compliance

- valuate potential investments against multiple industry standards and frameworks

- Provide automated remediation advice to promising targets

- Evaluate progress in real-time

Audit, Analyze, Identify

- Quickly determine a business’s security posture with smart questionnaires

- Assign people to specific questions

- Analyze and filter answers by type

Prioritize Your Risks

- Differentiate between inherent and residual risk

- Determine which risks will impact your acquisition

- Filter risks and remediation by severity

- Differentiate between inherent

and residual risk - Determine which risks will impact

your acquisition - Filter risks and remediation by severity

Go Beyond Due Diligence

- Mitigate cyber risk at every stage of the acquisition

- Integrate with third-party systems to streamline onboarding

- Leverage actionable threat intelligence for a big-picture view of risk

Make Smarter Acquisitions with Centraleyes

Risk management can be one of the most challenging elements of the M&A process. Faster and more effective due diligence is key to addressing this. Contact us now, and we’ll help you get started.