Compliance Management

- Home

- Compliance Management

Compliance Management

Businesses need to maximize their efforts to meet the demands of an evolving compliance landscape.

The digital wave we live in offers remarkable opportunities for corporate growth, but also introduces compliance risks that impact business strategy, brand reputation, and customer loyalty.

As technology proliferates, regulators around the world are tightening security and compliance requirements, making the penalty for noncompliance unbearable. Compliance directives continue to emerge in the digital landscape and companies are beginning to realize that pre-existing compliance management operations are not sufficient to meet growing regulatory demands. But many companies don’t develop an awareness of the pitfalls in the regulatory and compliance landscape until it is too late.

It’s a new world out there for the compliance function and you need to ensure that your organization

is ready to rough it.

There are still lingering issues related to the pandemic like remote or hybrid work environments, the explosion of digitization, cryptocurrency and virtual finances, Environmental Social and Governance (ESG) tracking and reporting, globalization of the supply chain, political extremism, major geopolitical events, the proactiveness of state legislators and regulators in consumer protections and privacy rights.

To help your organization’s compliance function deal with these challenges and more without breaking down, it’s important to take a step back and review the efficiency of your compliance management program. The strength of your compliance program will determine how well your organization can withstand today’s onslaught of regulatory mandates and legal scrutiny.

Centraleyes works through the compliance chaos experienced at many organizations, aligning companies with regulatory expectations and best industry practices.

New Technologies that Introduce Risk

- Multi-cloud or hybrid cloud infrastructures

- Third-party vendors

- Internet of Things (IoT)

- Artificial intelligence and machine learning

The adoption of new technology results in new types of security risks.

The phenomenon is known as digital risk. These risks are a direct result of digital transformation, and organizations need to learn how to manage digital compliance risks to gain more than they lose with the adoption of new digital technology.

Ironically, a significant percentage of compliance programs still work with spreadsheets and manual processes, while the development and operational departments have leapfrogged to advanced models of technology that integrate artificial intelligence and machine learning.

Apply Compliance Management to your organization today

Shallow Compliance Programs Lack Substance

For many business leaders, compliance standards are simply good advice to protect their company from worst-case scenarios, much like an expensive insurance policy. Employees may be required to sit through training events that prep them for the policies to be implemented.

They may even be asked to sign lengthy codes of conduct attesting to their understanding

of established compliance policies and make sure all the checkboxes are ticked off in the

standard checklist.

Even with all these outer trappings, uncomprehensive compliance management programs often lack direction and substance at their core, even as businesses spend millions of dollars annually on their programs.

Far-Reaching Effects of Insufficient Compliance Management

Your reputation rests on the shoulders of your compliance management program because overlooking regulations and mandatory standards can lead to a wide range of effects.

You can’t operate in a regulated industry and let compliance functions slip through the cracks. It is imperative to design functions that point to compliance risks and automate the process to create a competitive advantage.

If we were to establish an organization-wide compliance management process and create multiple layers of defense we would be in a better position to protect our most important business assets. Compliance isn’t just about protecting reputation and shareholder interest. It’s about protecting the conditions, jobs, and data of real people like you.

The strategies that got you to where you are today will not continue to get you to your goals without staying on top of your compliance efforts.

What is a Compliance Management System?

A Compliance Management System (CMS) is how an institution:

- Learns about its compliance responsibilities

- Ensures that employees understand these responsibilities

- Reviews operations to ensure responsibilities are carried out and requirements are met

- Takes corrective action and updates materials as necessary

A compliance management system starts with creating a security compliance management program that strategically involves IT, security, and compliance teams. The first task of the new program is to document the regulations and frameworks that must be followed. Then, a detailed risk assessment should be conducted to identify any current security and compliance gaps.

Components of a Compliance Management System

It is often challenging to distinguish substantive programs from those that are merely window-dressing. Take a look at any successful compliance management system, though, and you’ll find some key components that can’t be skipped.

Governance and Oversight

Compliance has evolved into a board-level agenda. An effective CMS will often trickle down from the top, so it’s important to have a communication system in place to spread the word on compliance issues of the day.

Some of the key actions that the board and senior management may take include:

- establishing clear compliance expectations

- selecting a compliance officer

- allocating resources to compliance tasks

- executing compliance audits

The board of directors should select a compliance officer as a first step in laying the groundwork for a compliance management program. In larger or more complex organizations, the compliance officer may spend their entire time on compliance-related duties. In smaller, less technologically advanced businesses with smaller workforces, this may be in the form of a dual-hatted employee who serves as the compliance lead among other responsibilities. Having a designated compliance resource allows that person to assume leadership in the compliance arena and helps employees understand compliance on a more practical level. No matter what their title, a designated compliance person — and their team, as necessary — should be capable of handling the position.

A Comprehensive Compliance Program

A written compliance program is a recommended step because it serves as a crucial source document that will be used as a training and reference tool for all personnel, in addition to being a planned and structured effort to direct the institution’s compliance efforts. A well-thought-out compliance program will prevent or lessen regulatory infractions and lubricate sharp corners of regulatory demands.

The central body of your compliance program is the policies and tools used to implement the compliance management system itself. It should be an ongoing, continuous process rather than a one-time consideration.

Compliance programs are as unique as the companies that create them. When creating a compliance program, the following should be considered:

- company size

- organizational structure

- business strategy

- product categories

- location of the business

- global events

- industry segment

Ultimately, the efficiency of your programs is more important than other formalities. This is particularly true for small businesses where the program may not be extensively documented but where an automated digital system has been put in place to guarantee comprehensive compliance.

Crucial Features in a Compliance Program

Policies and procedures

An effective Compliance Program requires a solid base of policies and procedures that describe what is expected in the workplace and how to conduct business in alignment with the compliance strategy. This enables smooth functions of the program and helps everyone in the company get on board in abiding by internal standards as well as local, state, as well as federal and international regulations.

Training

To sustain a successful compliance program, the Board, management, and staff must get the appropriate training. A successful compliance training program is regularly updated with the most recent, accurate, and comprehensive data on business processes, consumer protection laws and regulations, updates to internal rules and procedures, as well as new trends in the compliance field.

Upkeep and Maintenance

Several important tasks need routine maintenance.

- Staying current on evolving standards

- Ensuring that employees understand the importance of compliance requirements

- Aligning business objectives with compliance goals

- Reviewing and updating processes and operations

- Identifying and correcting violations when they occur

Monitoring

Monitoring is a proactive approach by the institution to identify procedural or operational weaknesses to implement controls that preclude regulatory violations.

An effective monitoring system includes regularly scheduled reviews of:

- State consumer protection laws and regulations

- Third-party service provider operations

- Internal controls and external controls

Complaint Response

Ever receive a complaint or inquiry from a customer or stakeholder? Every business should be responsive to these contacts, as the knowledge you gain from them is useful for developing future CMS efforts. Monitor interactions with clients to identify trends and areas where you can make improvements.

Auditing

When it comes to compliance, it’s not enough to be compliant. You’ll need to SHOW it and prove it. Organizations are required to be able to show compliance for each standard they adopt by providing an audit trail, which is frequently created using information from event log management software, as well as internal and external audits.

Initial compliance with a recognized standard is often verified by an independent party in the form of an audit or compliance certification process.

Once an organization is certified, it will be periodically audited by regulators or an internal audit team to ensure that security controls are working efficiently and requirements are being upheld as directed by the standard.

Successfully passing an audit is a ticket to increased trust and reputation-building. Conversely, a lack of robust auditing of the compliance program, stiff penalties can be incurred and damaging outcomes of poor cyber hygiene and data management may sprout up.

Common Setbacks of Compliance Programs

Most compliance programs suffer from common pain points, including:

- Lack of standardized controls across branches and departments, coupled with manual processes and spreadsheet systems that drive up costs, slow down productivity and introduce siloed tasks and operational redundancies

- Ad hoc tools are used for security and risk management, with many of them being legacy tools, limiting the ability to aggregate relevant data and also inhibiting scalability.

- Check-box approach to compliance often fails to sustain momentum over time, exposing businesses to new risks as they develop

The Difference Between Compliance and Risk Management

The most obvious difference between compliance and risk management lies in their end goals.

- The end goal of compliance is to assure all rules are followed.

- The goal of risk management is to make sure there is a strategy in place to account for every risk a company could face.

Bringing Compliance & Risk Management Together

Compliance management and risk management need to work in tandem to ensure the entire company is following the necessary rules and having solutions in place for risks that may occur. One of the best ways to bring these two departments together is by using an integrated solution like Centraleyes.

Centraleyes allows compliance and risk management departments to work together by giving them an easy way to track internal risks as well as

third-party vendor risks and align those risks with a recognized framework to structure the strategy of the management program.

It is strongly advised that compliance teams proactively focus on risk management and monitoring and that the compliance management program is risk-based. To provide independent monitoring of the control structure, the compliance team must go beyond a “check-the-box” compliance mindset. They must also provide advice on statutory rules, regulations, and laws as well as take an active role in co-owning risks. By doing this, you’ll gain a solid understanding of how the organization operates, the risks it faces, how to practically translate legal requirements into managerial decisions, and more.

Compliance efforts frequently lack a clear association with a larger risk management framework, largely yielding a dramatic increase in wasted compliance control spending with limited impact on the residual risk profile.

Apply Compliance Management to your organization today

Risk Assessment as a Foundation for Compliance Management

As global regulations proliferate, and as stakeholder expectations increase, organizations are exposed to a greater degree of compliance risk than ever before. To help you stay afloat with the proliferation of global regulations and mounting stakeholder expectations, you’ll need to understand the full spectrum of compliance risks lurking in each part of the organization. They then need to prioritize which risks have the greatest potential for legal, financial, operational, or reputational damage and allocate limited resources to mitigate those risks.

Risk assessments empower companies to identify risks at an early stage, develop appropriate strategies and countermeasures and continuously improve their compliance program.

In the event of compliance violations, the risk assessment enables you to demonstrate what steps had already been taken to avoid or reduce the risk in question. This evidence puts companies in a much better position vis-à-vis any regulator than if the underlying risk had not been identified. It is therefore worth investing time and resources in compliance risk assessment.

To address changes in the way business is done in the post-pandemic era, an effective risk assessment should factor in the following considerations:

- How employee behavior and ways of performing work tasks day to day have shifted

- Whether new regulatory requirements apply to the business

- What changes, if any, have occurred in the company’s supply chain

- Updates to the jurisdictions, functions, and manners in which the company’s data is stored, shared, and secured

- Changes in how the company approaches marketing, business development, and other external-facing activities

- Whether there have been changes in technological systems or digital tools

New Goal for Compliance: Becoming Risk Intelligent

Many organizations are finding ways to better manage compliance risks and be more risk intelligent, which involves being more aware of today’s risks. To accomplish this you’ll need to adopt an integrated compliance framework that covers your compliance risks and keeps them in check.

It requires a holistic approach to managing compliance in an organization. The goal is to provide a single, enterprise-wide solution for managing compliance. The benefits of an integrated compliance strategy include reduced risk, faster time to market, reduced costs, enhanced customer experiences, and more.

Adopting a Framework for Compliance Management

A compliance management framework provides a detailed guide of security controls that address your compliance risk and also provides practical implementation steps to reduce it.

You can build your compliance framework from scratch or choose to leverage an existing framework like the COBIT 5 Framework and the Unified Compliance Framework.

A framework is a foundational structure that supports a bigger entity. A compliance management framework is a specialized structure set up to manage an organization’s level of risk, which is a straightforward enough extension of that description.

How you can use processes to manage technology, ensure supervision, and assure compliance will be defined by a compliance framework.

Challenges of Compliance Management Programs

The creation and maintenance of a compliance management program are highly advantageous. However, there are several common problems that businesses face. They include:

- Since frameworks are dynamic and frequently updated, companies should stay abreast of changes as they occur to realign their policies in light of the modifications. Although this can be a challenge, it is vital to protect company assets and avoid penalties.

- Ineffective communication between teams increases the risk of a breach or failing a compliance audit. In a larger organization, more communication is needed to make educated decisions and uphold compliance.

- Compliance Overlap: Most large companies are regulated by several mandates which means they must abide by all applicable laws and regulations that apply to their industry or government. This often creates redundancies between framework requirements and compounds the work of evidence collection and compliance audit trails. The extreme volume of collection and analysis required to keep up with compliance demands can easily result in “regulatory fatigue”.

Cut Out Compliance Management Pain Points with GRC Technology

With an automated GRC solution, you can easily round the corners to smooth

the transition to compliance.

- Understand the practical implementation of framework requirements, defining and limiting their scope

- Assess your compliance progress through an orchestrated and automated methodical assessment to break down silos and eliminate redundancies and duplication of effort.

- Automated GRC can help improve morale, increase efficiency, and improve decision-making.

- Enable collaboration across teams to efficiently collect and organize artifacts for an audit

- Produce reports for auditors at the click of a button

- Automate control cross-walking across multiple compliance frameworks

- Give management full visibility to oversee and track all ongoing processes

Best Practices for Effective Compliance Management

The best way to surf over compliance waves is with an adaptable approach that will monitor infrastructure and environments, identify any regulatory gaps and updates, and provide actionable steps to mitigate compliance risks.

These best practices can help you stay abreast of any regulatory changes and keep your systems compliant:

Deploy Automation

Infrastructure will become more difficult to manage manually as it grows and changes in size and type.

Automation is your best bet for cutting down on time involved in remaining compliant. Some common ways to automate your security compliance include:

- Regularly generate reports necessary to prove compliance or inform the effectiveness of risk-mitigating controls.

- Reduce duplicative efforts by answering smart questionnaires that apply across multiple frameworks and regulations.

- Centralize updates provided by frameworks and regulatory organizations rather than manually hunting down changes.

Consistent Patching and Testing

Keeping systems up to date can boost security, reliability, performance, and compliance. Patches should be applied once a month to keep pace with important issues, and patching can be automated. Patches for critical bugs and defects should be applied as soon as possible. Be sure to test patched systems for acceptance before placing them back into production.

Connect your Digital Dots

Distributed environments often contain disparate tools for various compliance functions. Integrate as many tools as possible into a centralized dashboard. Most cloud security compliance platforms provide an API that enables integration with other tools or in-house dashboards. Put them to work and prevent critical missing details. Using a centralized platform interface streamlines operations and improves visibility into the security and compliance status of your security ecosystem.

Continuous Monitoring and Framework Reassessment

Don’t wait for a framework to enforce changes; proactively understand the risks facing your organization and the effectiveness of the controls meant to mitigate them. Regularly revise your security assessment to determine if the chosen controls protect against the risk or if vulnerabilities remain that need to be addressed.

Periodically reassessing your frameworks can be crucial to ensure your ongoing compliance and risk posture. With Centraleyes you can easily automate any reassessment tasks down to the individual question level at the click of a button. Emphasize critical controls and make sure they are never missed.

For each framework, you can set up as many reassessment cadences as you’d like by simply setting dates in the frequency of your choice. The platform will automatically send out notifications to control owners when it is time to reassess the questions they’ve been assigned to.

Risk-based Task Prioritization

Prioritization of actions based on your unique risk appetite and risk tier helps you make the most of time-sensitive patching windows.

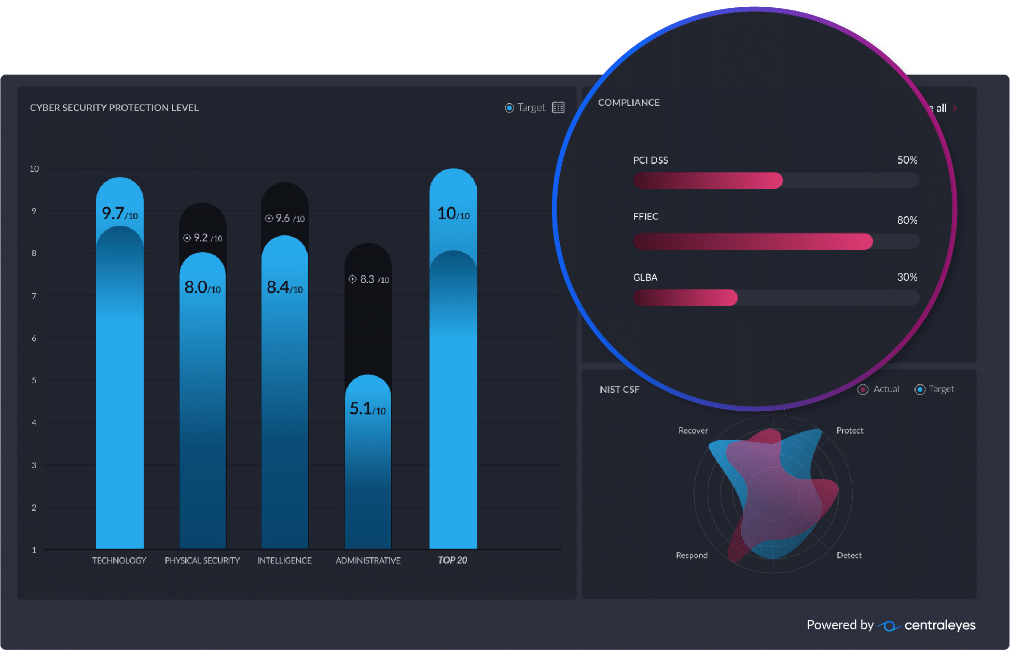

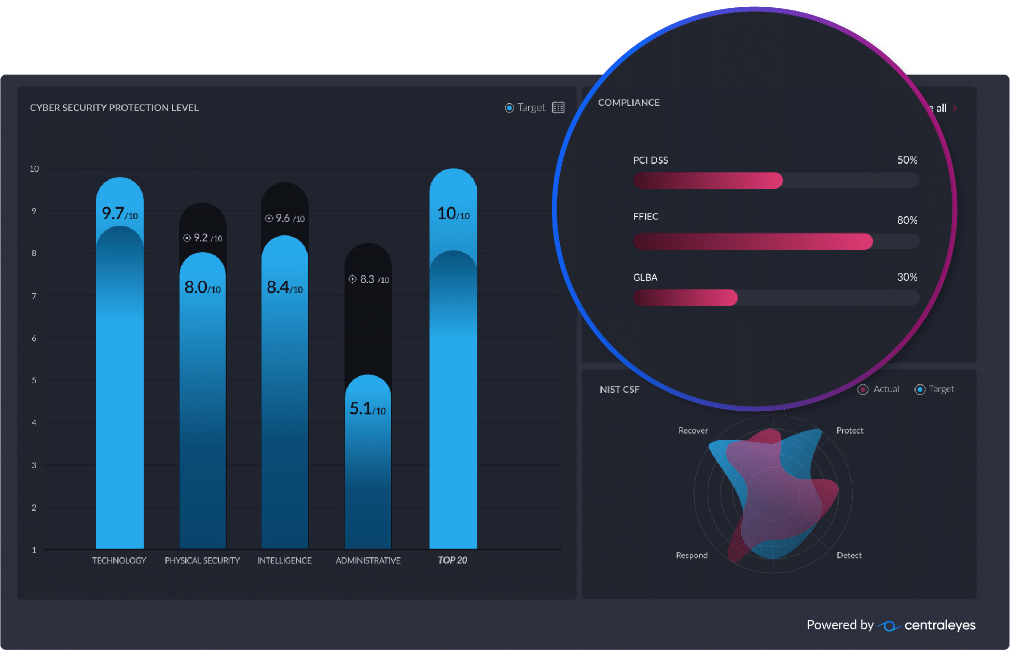

In the latest Centraleyes release, we’ve added a NIST Tiering capability to the platform, which allows you to use each of the NIST tiers as a lens to your organization’s risk scoring. You can focus on a primary tier, get more information on each tier and see how you score based on that specific tier.

Navigate Frameworks Visually

The Centraleyes platform has a unique breakdown screen that allows you to navigate through different frameworks in a highly visual and intuitive way. Each framework layer expands into sub-layers allowing you to see five layers below in a very detailed fashion.

The layers are also color-coded and interactive, allowing for quick and easy navigation and explaining how each framework is being implemented, where your strengths and weaknesses lie, which specific controls are being met, and which are not. With this unique tool, you can directly drive automatic workflows and remediation plans.

Accurate Metrics and Reporting

By aggregating reports and metrics that are easy to understand and that show you progress and gaps in your compliance strategy, the Board will better understand the environment and condition of your compliance management program.

The Centraleyes Boardview module consists of five emphasis areas: Risk Score, Compliance Status, Threat Level, Monitoring, and Operational. You may delve further and examine the data at a more detailed level for each tier to better understand the trend analysis and how things are moving inside the firm.

Is Compliance Management Expensive? What About Non-compliance?

The cost of compliance is always increasing but when things go wrong, the cost is a lot higher. Fines, penalties, and litigation costs may add up to staggering amounts. In addition, the reputational damage that extends from compliance failures can drive further costs. When companies adhere to a structured compliance program, these additional costs can be largely avoided.

The “avoidance approach” is problematic on several accounts. Firstly, the cost of non-compliance is nearly three times higher than the cost of compliance management. The fines and penalties alone are a strong argument in favor of proactive prevention vs. regret.

But the monetary costs of noncompliance are just the beginning. The impact of compliance lapses extends much further than that. Expensive legal action, operational disruptions, reputational damage, and investor turnoff are all part of the bottom-line total of the astounding costs of noncompliance.

HIPAA Compliance Violations

Penalties are virtually always imposed for violations of the Health Insurance Portability and Accountability Act. A state attorney general or the Office for Civil Rights (OCR) of the U.S. Department of Health and Human Services can impose civil penalties.

The severity of the punishment depends on many variables, including the number of people impacted, the type of data revealed, and whether the organization was aware of the infringement. The Department of Justice may bring criminal charges against those who violate HIPAA.

GDPR Compliance Violations

Companies conducting business in the European Union must comply with the General Data Protection Regulation (GDPR). The maximum fine for a firm for violating the GDPR is 20 million euros ($22.8 million), or 4% of its yearly global revenues.

PCI DSS Compliance Violations

Companies that gather, process, transmit, or store client credit card information is subject to the Payment Card Industry Data Security Standard (PCI DSS). If a security breach occurs, non-compliant firms could be subject to a punishment of up to $500,000. Banks or payment processors are the ones who levy these penalties. In the worst scenarios, a retailer can be completely prohibited from accepting credit card payments.

Turn Compliance Management into a Competitive Advantage

Regulatory and privacy-related laws have put virtually every business on the compliance radar. Add to that the direct and residual costs of compliance violations, and it’s clear why compliance management systems are a must-have in 2023.

Centraleyes takes a comprehensive approach to compliance by consolidating all your compliance needs into one solution that can be customized to work in any industry, from finance to healthcare.

Built on the presumption that a fragmented approach to GRC creates confusion, our platform cuts across silos by enabling users to coordinate and unify compliance management activities across all business functions. In addition, organizations can align their security programs to recognized security frameworks and gain comprehensive visibility into their risk exposure. The solution strengthens resilience, enhances agility, and quite simply, turns compliance into a competitive advantage.